Market Commentary | May 2021

THE MARKET

The markets started off strong in May before running into inflation fears towards the middle of the month. After those fears were somewhat curbed by the Fed, markets rallied to end the month. The S&P 500 index is up nearly 12% on the year after it finished the month of May up 0.55%. This is the fourth positive month in a row for the index after it finished down just over 1% in January. The Dow Jones Industrial Average (DJIA) finished the month up nearly 2% and is now up 12.82% on the year. The technology heavy NASDAQ did not fair as well during the month as it declined 1.53% and is now up 6.68% on the year. Small cap stocks were relatively flat for the month as the Russell 2000 finished up 0.11%. The MSCI EAFE and EM indices both finished in positive territory as well.1 As we enter the summer months, June has traditionally been a weak month for markets as the DJIA is averaging 0.12% over the last 50 years, and it is down an average of 0.7% over the last 20 years. However, July and August are traditionally good months for the index as it averages an increase of 3% over its 125-year history.2

| Index Returns (as of 5/28/2021) | Level | May | YTD |

|---|---|---|---|

| S&P 500 | 4204.11 | 0.55% | 11.93% |

| Dow Jones Industrial Average | 34529.45 | 1.93% | 12.82% |

| NASDAQ Composite | 13748.74 | -1.53% | 6.68% |

| Russell 2000 | 2268.97 | 0.11% | 14.89% |

| MSCI EAFE | 2341.39 | 3.21% | 9.03% |

| MSCI Emerging Markets | 1360.78 | 0.98% | 5.38% |

| U.S. Aggregate Bond | - | 0.33 | -2.29% |

Source (1)

Source (2)

EARNINGS

The first quarter earnings season is officially coming to a close as over 95% of the companies in the S&P 500 have reported. Of those companies, 86% reported positive surprises for earnings per share (EPS) and 76% reported positive revenue surprises. This marks the highest percentage of companies reporting a positive EPS surprise since the firm began tracking the data.3 FactSet began tracking earnings estimates in the second quarter of 2002.4

THE ECONOMY

Much of the positive earnings can be attributed to poor performance in 2020, but also the pentup demand being realized as the economy reopens and the financial stimulus provided by the government. Our economy is currently expanding as evidenced by the recent ISM manufacturing numbers. The ISM Manufacturing Index rose to 61.2 for the month of May, higher than the expected 60.9. Any number above 50 means that the factory sector of the economy is currently expanding.5

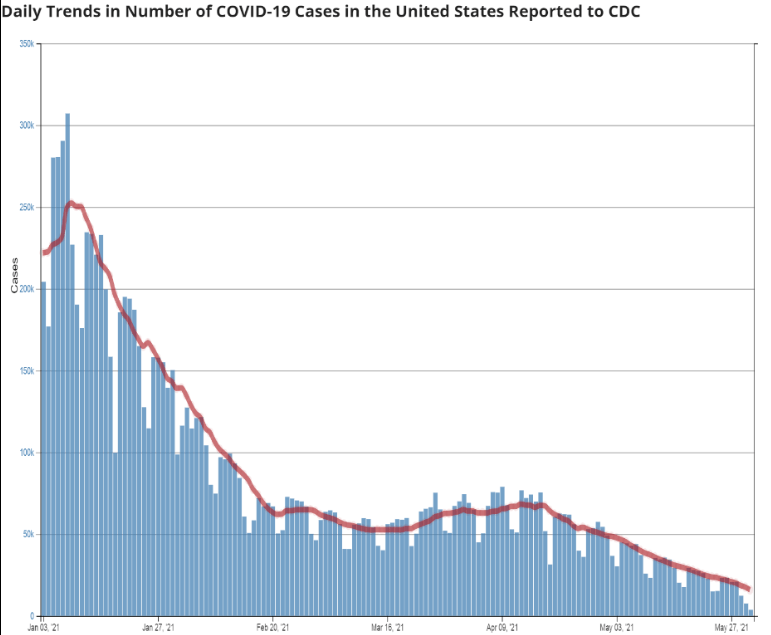

The success of the vaccine continues to lead the charge for economic recovery. Virus cases continue to decline as roughly 50% of the United States population has received at least one dose of the vaccine.6 President Biden has set a goal of at least 70% receiving one dose by the 4th of July, 2021.7 The CDC approved Pfizer’s vaccine for individuals as young as 12, and also announced

that fully vaccinated individuals do not need to wear a mask in public.8 All positive signs towards the full reopening of the U.S. economy. Larger cities are beginning to fully reopen as Chicago has announced that it plans to be fully open by July 4th, 2021.9

Source (10)

Jobless claims reached a new pandemic low on May 27th as they came in at 406,000 which is lower than the estimate of 425,000. The May jobs report comes out on Friday, June 4th, and it will be closely watched considering the large disappointment in April. New job estimates were 1,000,000 for April and they came in at only 266,000 while unemployment creeped back up over 6%. That was seen as a large disappointment as the economy currently has millions of unemployed citizens combined with a worker shortage. Bloomberg reported that, “many employers say they are unable to fill positions because of ongoing fears of catching the coronavirus, child-care responsibilities and generous unemployment benefits.” Despite this, there is still positive news surrounding May as estimates are coming in with an unemployment decrease to 5.9% and a job increase of 674,000.11

THE FED

As previously mentioned, the Fed’s comments regarding inflation helped to spark the equity rally that finished out the month of May. On May 19th, the Fed released their minutes from their April meeting stating that it may be time to reassess the plan of their bond purchases should the economy continue to grow at such a rapid pace.12 This is a shift from their comments in March and the first real sign that the Fed is entertaining the idea of tapering back their bond purchases. These comments helped to curb fears of inflation.

The Federal Reserve is scheduled to meet again on June 15-16, and it is always critical to monitor their response to the current economic conditions. The remainder of 2021 will be a question of if the Fed will stick to its word. Will they maintain their current target interest level and continue to buy bonds each month? Inflation rose 4.2% year of year for the month of April which can be expected considering the low levels in 2020, but it also rose 0.8% from March to April of 2021 which is hard to ignore.13 As of now, the Fed maintains that current inflation fears are transitory. However, if they keep target interest rates at 0.00% to 0.25% and continue to purchase $120 billion worth of bonds each month, inflation may not be temporary after all. Jay Hatfield, founder, and CEO of Infrastructure Capital Advisors claims that the fed will have to change its messaging in the coming months stating, “The idea that they’re not going to taper, and inflation is transitory is not sustainable.” 14

Evidence supporting the Fed staying the course can be found as the Fed has stated that they will maintain their current outlook until they see signs that the economy is truly healing and unemployment is back to lower levels. Until the Fed believes that inflation is too high or that the economy will be able to progress without this much monetary support, we will continue to see lower interest rates. The Fed’s main weapon to combat inflation is higher rates, but higher rates could lead investors to choose higher yielding fixed income investments over equities. The Fed is not expected to raise rates until 2023, but they could decrease bond purchases as early as 4th quarter 2021. The Fed’s response will be one of the more important items to follow in the coming months as Jay Hatfield stated, “Fed watching is always critical. If you get Fed policy right, you get the market right” in terms of the direction it’s headed.14

CONCLUSION

As we’ve stated for much of 2021, there will be volatility ahead. The choppy month of May for the markets has proved that. The S&P 500 started the month off strong, fears of inflation caused a slight pull back, and the release of the Fed’s meeting minutes sparked the month end market rally. We believe the economy is in more of a reflationary environment as the economy is being stimulated back to its long-term trend line. It is a sign of “good” inflation in our eyes, which is why the Fed has yet to react. At some point, the price levels will surpass their long-term trend lines and the Fed will have to react accordingly, but we don’t believe that we are there yet. We maintain that is wise to invest in a diversified portfolio based on risk tolerance. Price levels should continue to rise and the best way to keep pace will be exposure to equity markets, but also smaller amounts of exposure to commodities that keep pace with inflation. If you’d like to revisit your risk tolerance, or discuss the current investments in your portfolio, please don’t hesitate to reach out and schedule a meeting today.

1 https://www.investing.com/indices/major-indices

3 https://www.nasdaq.com/articles/may-2021-review-and-outlook-2021-06-01

8 https://www.cnn.com/2021/05/12/health/acip-cdc-pfizer-vaccine-teens/index.html

10 https://covid.cdc.gov/covid-data-tracker/#trends_dailytrendscases

11 http://www.crossingwallstreet.com/archives/2021/06/cws-market-review-june-1-2021.html

12 https://www.federalreserve.gov/newsevents/pressreleases/monetary20210519a.htm

13 https://www.cnbc.com/2021/05/12/consumer-price-index-april-2021.html

14

https://www.forbes.com/advisor/investing/june-2021-stock-market-outlook/

Returns are based on the S&P 500 Total Return Index, an unmanaged, capitalization-weighted index that measures the performance of 500 large capitalization domestic stocks representing all major industries. Indices do not include fees or operating expenses and are not available for actual investment. The hypothetical performance calculations are shown for illustrative purposes only and are not meant to be representative of actual results while investing over the time periods shown. The hypothetical performance calculations for the respective strategies are shown gross of fees. If fees were included returns would be lower. Hypothetical performance returns reflect the reinvestment of all dividends. The hypothetical performance results have certain inherent limitations. Unlike an actual performance record, they do not reflect actual trading, liquidity constraints, fees and other costs. Also, since the trades have not actually been executed, the results may have under- or overcompensated for the impact of certain market factors such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. Returns will fluctuate and an investment upon redemption may be worth more or less than its original value. Past performance is not indicative of future returns. An individual cannot invest directly in an index.

This material has been prepared for information and educational purposes and should not be construed as a solicitation for the purchase or sell of any investment. The content is developed from sources believed to be reliable. This information is not intended to be investment, legal or tax advice. Investing involves risk, including the loss of principal. No investment strategy can guarantee a profit or protect against loss in a period of declining values. Investment advisory services offered by duly registered individuals on behalf of ChangePath, LLC a Registered Investment Adviser.

P:

888.798.2360 F:

913.661.1183

6330 Sprint Pkwy Suite 400, Overland Park, KS 66211

Disclosure: Continuity planning offered through CreativeOne Wealth, LLC and CreativeOne Securities, LLC. CreativeOne Wealth, LLC. advisory services offered through CreativeOne Wealth, LLC, a Registered Investment Adviser. CreativeOne Securities, LLC. Member FINRA/SIPC and an Investment Advisor.

Privacy Policy | ADV Part 2A | Form CRS

© 2023 Creative One Marketing Corporation, CreativeOne Wealth, LLC and CreativeOne Securities, LLC.